Friday, 31 August 2012

UK house prices record surprise increase

Surprising? Why is it surprising?

This economy is dragging its feet towards a long-term decline. As no structural reforms are being implemented, it is drifting chaotically. The only preoccupation of the government is the interests of the groups they represent are not dented. Essentially, that the wealth of the medium to large businesses owners and executives is at least preserved if not increased. The propagandistic "wealth creator alienation danger" theme is unfolded over and over again in the face of the stunned tax payer.

The variations of total unemployment, economic performance or housing prices are small and unsurprising. This government's motto is "business as usual".

For instance, quality employment cannot be ensured without a drastic reform of education, R&D and investment strategies.

When one looks into details of the headline statistics the long-term unemployment, the fall in productivity, the decrease of real pay in the private sector, the increase in temporary jobs or "self-employment" show the bitter consequences of the crass negligence of the government.

The housing supply, standards and planning systems are all in desperate need of revamping. The patchy solutions advanced so far, e.g. subsidize loans, subsidize banks profits, cut even further social housing (and subsidize builders' profits), roll the red carpet under the feet of whomever can hand over the millions for trophy mansions, managed to successfully protect the landlords' wealth.

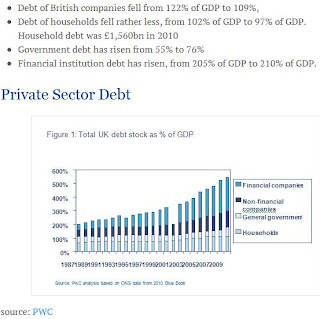

Let's have a look at the graph below:

How sustainable is it? Where must the interest rates stay for a London family with two children, making £70,000, to buy today a house for £450,000 (and pay between £5 and 6 grand per square meter)? How can they afford a £2,500 per month mortgage? How is their real income going to grow above the rate of GDP? What levels of consumption can these people maintain? Who's going to sell the house to if the Britons already have a debt equal to the GDP? How many more Greeks or Russians need to keep on buying houses in London for this family to sell their house for a profit in 2022? It is very likely this government will not build houses on the scale needed to put the housing market on a more healthy basis, i.e. to bring the average house price to income in London to a more palatable 5 over the next 5-7 years.

It is therefore likely we'll live through many years of a relatively stable market from the price per unit perspective, deteriorating stock, smaller dwellings and higher prices / square meter, bigger segregation and lower living standards for most Londoners.

At least don't be surprised!

http://www.ft.com/cms/s/0/e43dc7e4-f355-11e1-9ca6-00144feabdc0.html#axzz258A4Nx2X

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment